When you purchase through links on our site, we may earn an affiliate commission. This doesn’t affect our editorial independence.

Moniepoint Inc., established in Nigeria in 2019, is one of the most used fintechs in Nigeria and Africa, competing with the likes of OPay, Palmpay, and others. Moniepoint is a prominent fintech company in Nigeria. The Financial Times dubbed Moniepoint Africa’s fastest-growing fintech in 2023 and 2024. It offers all-in-one banking and payment solutions to Nigerian consumers and businesses.

With diaspora remittances in Nigeria rising to $21 billion in 2024, this market clearly needs more capable hands to ensure service delivery to customers and businesses. Information has it that diasporan remittances from the United Kingdom alone accounted for about 50% of overall remittances to Nigeria by 2024.

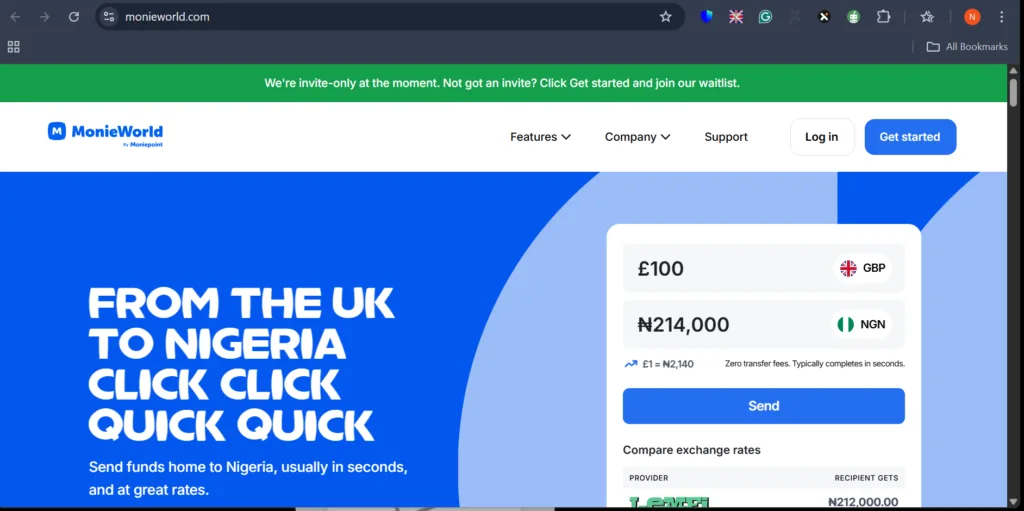

In 2025, it released its UK app, focusing on the diaspora’s annual remittances of almost $21 billion. Fintechs like LemFi and Send, which Nigerians in the UK already use, will face stiff competition from Moniepoint’s recent arrival in the UK market. They have a proven track record in Nigeria for faster transaction times and a simple registration process. This move is also Moniepoint’s first venture outside of Africa.

From MoniePoint to MonieWorld

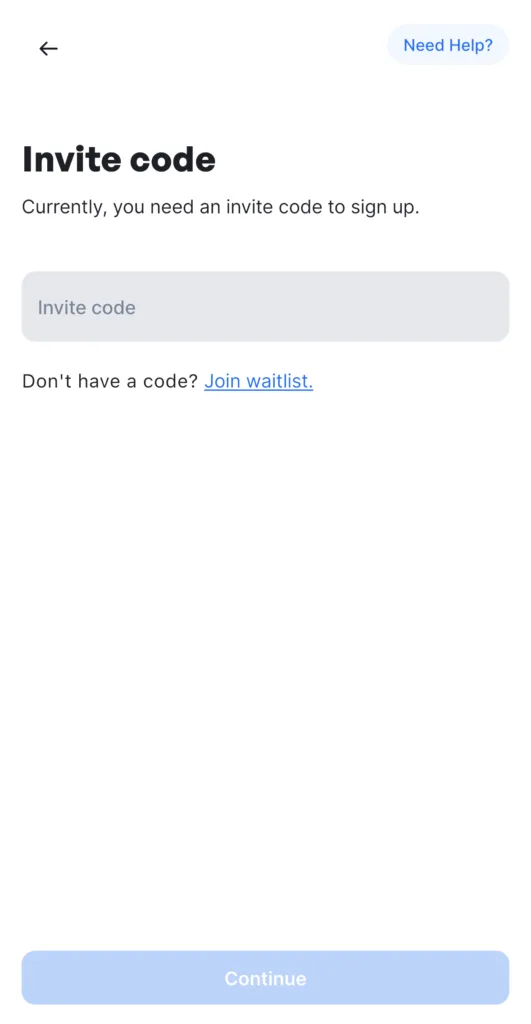

Moniepoint GB, a London-based subsidiary, runs the UK branch. The UK app is already available on Apple Store and Google Play under the name MonieWorld. The app allows UK residents and businesses to transmit money and conduct other banking operations to Nigeria with ease. Although other industry players are already rendering these services, the debut of MonieWorld comes with greater anticipation. The Moneyworld app was released in February 2025, considering update logs from the App stores. As of the time of writing this article, the MonieWorld app reveals that not everyone can use the new app. Membership is through referrals, and completing the sign-up process requires an invite code.

Moniepoint’s entry into the UK money transfer market is anticipated to improve the way money transactions are conducted. Based on Moniepoint’s record in Nigeria, the current players will have to sit up.