When you purchase through links on our site, we may earn an affiliate commission. This doesn’t affect our editorial independence.

Following recent developments, Nigeria has emerged as a leader in Africa’s fintech landscape in 2025. This is despite a slowdown in funding across much of the continent. In the first quarter of the year, Nigerian startups raised over $100 million, and the majority of the funding went into fintech companies. This trend among fintech companies in Nigeria reveals the resilience of these ventures and their central role in the country’s digital economy.

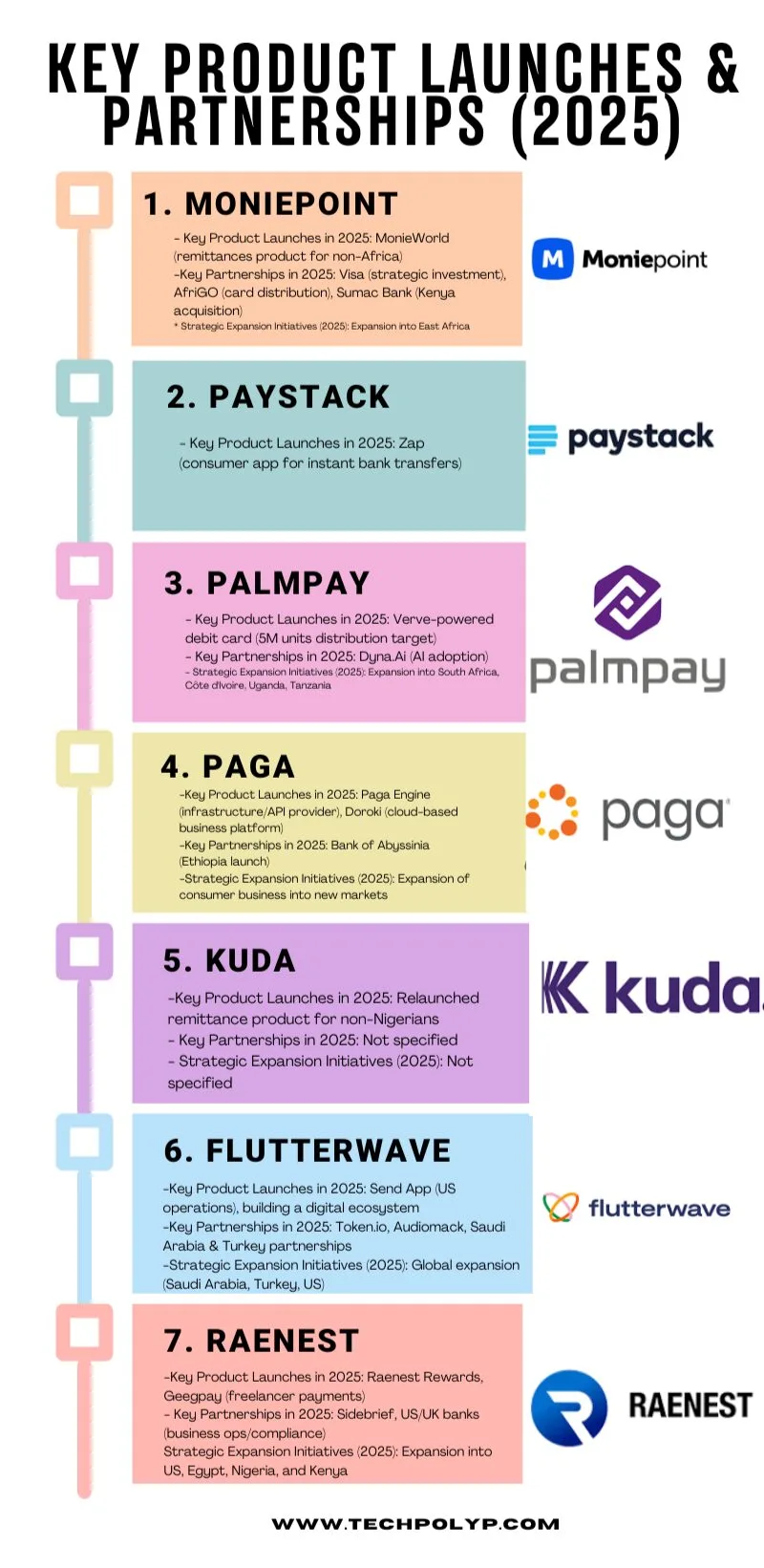

Moniepoint, Paystack, PalmPay, Paga, Kuda, Flutterwave, and Raenest are driving Nigeria’s financial technology growth. These fintech companies in Nigeria are expanding rapidly. They onboard new users, secure fresh capital, and release innovative products. It is noteworthy that the result is a thriving ecosystem which is reshaping how Nigerians save, spend, borrow, and invest.

In furtherance of the above, this report investigates the leading fintech companies in Nigeria in 2025. Notably, it covers user growth, funding rounds, product launches, and the broader economic impact. Additionally, the profiles provide clear insight into why Nigeria remains Africa’s financial technology hub.

1. Moniepoint: One of the Leading Fintech Companies in Nigeria

Moniepoint is formerly known as TeamApt, for the record. It has emerged as one of the most dominant fintech companies in Nigeria today, thanks to the efforts of the management team and the consequent adoption by users. Moniepoint made TIME’s 100 Most Influential Companies list and became a unicorn after securing $120 million in Series C funding. Interestingly, the round included a $10 million investment from Visa.

In Case You Missed It:

Furthermore, Moniepoint provides tailored digital banking services nationwide in Nigeria with a focus on small businesses. It’s notable that the company now serves over 10 million users. Beyond this development, it also processes more than a billion transactions each month. Similarly, TechPolyp discovered that its payment volume exceeded $100 billion in the previous year.

In 2025, Moniepoint expanded beyond Nigeria’s boundaries after receiving approval to acquire a controlling stake in Kenya’s Sumac Bank. The brand also launched MonieWorld to facilitate international remittances and partnered with AfriGO to distribute five million payment cards. This growth confirms Moniepoint’s position as one of the most strategic fintech companies in Nigeria and across the continent.

2. Paystack: One of the Leading Fintech Companies in Nigeria

Since Paystack Stripes acquired Paystack in 2020 for $200 million, the brand has continued to build on its outstanding performance. Stripe is one of the leading fintech companies in Nigeria. Additionally, it has grown its presence in Ghana, Kenya, Côte d’Ivoire, and South Africa.

In Q4 of 2024, Paystack processed over $250 million in monthly transaction volume. The company handled over three billion API requests within just three months. Moreover, bank transfers now account for the majority of transactions on Paystack’s platform. Furthermore, this represents 58% of total transactions in 2023, up from 28% in 2022.

Performance Overview of Top Nigerian Fintech Firms (2025). Source: TechPolypMarch 2025 marked the launch of Zap, Paystack’s first consumer-facing product in nearly a decade. Zap enables instant money transfers to any Nigerian bank in less than ten seconds. Users can link existing bank accounts or deposit funds directly into a Paystack-Titan Trust Bank wallet. While Zap accepts global debit and credit cards, it focuses primarily on facilitating domestic transactions. Paystack’s innovation and infrastructure investments reaffirm its leadership among fintech companies in Nigeria today.

3. PalmPay

PalmPay is rapidly gaining momentum as one of the fastest-growing fintech companies in Nigeria. Additionally, it ranked second on the Financial Times’ list of Africa’s top-performing startups. Furthermore, in Q1 2025, PalmPay had over 35 million users and processed more than 15 million daily transactions.

Notably, between January and December 2024, PalmPay handled ₦71.5 trillion in transaction volume, maintaining an 80% monthly user retention rate. The company collaborates with over a million agents and merchants across Nigeria. This enables financial inclusion at scale. PalmPay’s growth plans include expanding into South Africa, Côte d’Ivoire, Uganda, and Tanzania. Its aggressive expansion and consistent performance place it among the strongest fintech companies in Nigeria this year.

4. Paga: One of the Leading Fintech Companies in Nigeria

Since its 2009 launch, Paga has remained a consistent player among the top fintech companies in Nigeria. Privately owned and profitable, Paga has processed over ₦23 trillion in payments since its inception. Paga now serves more than 21 million users, many of whom transact through a vast network of mobile agents. In 2024, Paga processed ₦8.7 trillion. Monthly volumes in 2025 have now crossed ₦1 trillion, a strong signal of continued relevance and trust.

The company runs three separate verticals: Paga for retail payments, Doroki for SME services, and Paga Engine for infrastructure. These product lines demonstrate how fintech companies in Nigeria are evolving into all-in-one platforms that offer more than just payments.

5. Kuda

Kuda also remains one of Nigeria’s most dynamic digital banks. Notably, in Q1 2025, Kuda processed over 300 million transactions worth ₦14.3 trillion. Of that, ₦8.5 trillion came from individual users, and ₦5.8 trillion from business accounts, a product it only launched in 2022. The bank issued ₦16.4 billion in overdrafts within the same quarter. It uses an innovative, risk-based lending model that adjusts interest rates based on customer behaviour. This approach helps expand credit access without increasing risk. Kuda forecasts a total transaction volume of ₦ 57 trillion by year-end. The company also reintroduced its remittance feature, targeting Nigerians abroad who want to send money home. With these moves, Kuda joins other fintech companies in Nigeria building robust digital finance ecosystems.

6. Flutterwave: One of the Leading Fintech Companies in Nigeria

The company remains Africa’s most valuable fintech, valued at $3 billion in 2025. Flutterwave has processed over 890 million transactions, totalling more than $34 billion since its founding. The company’s infrastructure now spans 34 countries across Africa.

Recently, Flutterwave secured a payment institution license from the Central Bank of West African States (BCEAO), enabling it to operate in Senegal with full regulatory approval. Flutterwave’s influence continues to shape the digital economy across Africa. It stands tall among fintech companies in Nigeria that are scaling global infrastructure from a local base.

7. Raenest

Raenest supports freelancers, remote workers, and digital entrepreneurs with seamless international financial tools. In February 2025, it raised $11 million in a Series A extension, bringing total funding to $14.3 million. From its inception, Raenest has processed over $1 billion in payments. The platform now supports over 700,000 individuals and more than 500 businesses. Its core services include multi-currency wallets, global transfers, virtual cards, and low-fee withdrawals.

The company’s Geegpay service was built specifically for freelancers and digital creators. In 2025, Raenest also launched Raenest Rewards, a loyalty program, and partnered with Sidebrief to help businesses expand across Africa, the U.S., and the U.K. Raenest exemplifies the new wave of fintech companies in Nigeria focusing on cross-border financial empowerment.

Final Note

It is worth noting that the narrative surrounding fintech companies in Nigeria is evolving. The story is now beyond merely processing payments or issuing cards. Added to their giant strides is an offering of a range of services, which include, but are not limited to, banking, lending, and compliance. Additionally, these companies now handle remittance and full-stack infrastructure.

Fintech companies in Nigeria now solve real financial problems with urgency and innovation. They are in the business of rewriting the rules of competition in one of the continent’s most complex markets. However, a final note of address is that the fintech companies in Nigeria that thrive will be the ones that build trust and execute swiftly. They will also be the ones who create products that improve daily life. Additionally, bold leadership, innovative partnerships, and a clear understanding of user needs shape fintech companies in Nigeria. Developmentally, this positions the companies to shape Africa’s financial future, one transaction at a time.