When you purchase through links on our site, we may earn an affiliate commission. This doesn’t affect our editorial independence.

In Africa, cross-border transactions have witnessed delayed payments, and lack of accountability. Truthfully, several freelancers (techy and non-techy persons), merchants, and small businesses lose opportunities because they can’t really repose their trust in online payment systems. However, the evolution of the Pandascrow escrow system has come to close that gap by offering an escrow-driven solution. This covers both buyers and sellers, brings back confidence, and lays a background of trust for digital trade across the continent.

In a recent TechPolyp interview, Precious Toms, the Founder and the Managing Director shared deep insights about the Pandascrow escrow system. The session focused on how the platform is helping Africans carry out cross-border transactions safely. It began with technical setups, followed by introductions, and then a detailed conversation about Pandascrow’s model, its security design, user experience, and vision. The goal of the meeting was to understand how trust can shape the future of digital payments in Africa.

Nelson Saliu and Adewuyi Omotola, both representing TechPolyp, explained that they focus on emerging tech stories and innovative startups. Their goal was to explore how Pandascrow fits into Africa’s digital commerce story. According to Precious, the Pandascrow escrow system was built to restore confidence in digital payments. He emphasized that African users deserve a payment system they can rely on without fear of fraud.

Introducing the Pandascrow Escrow System

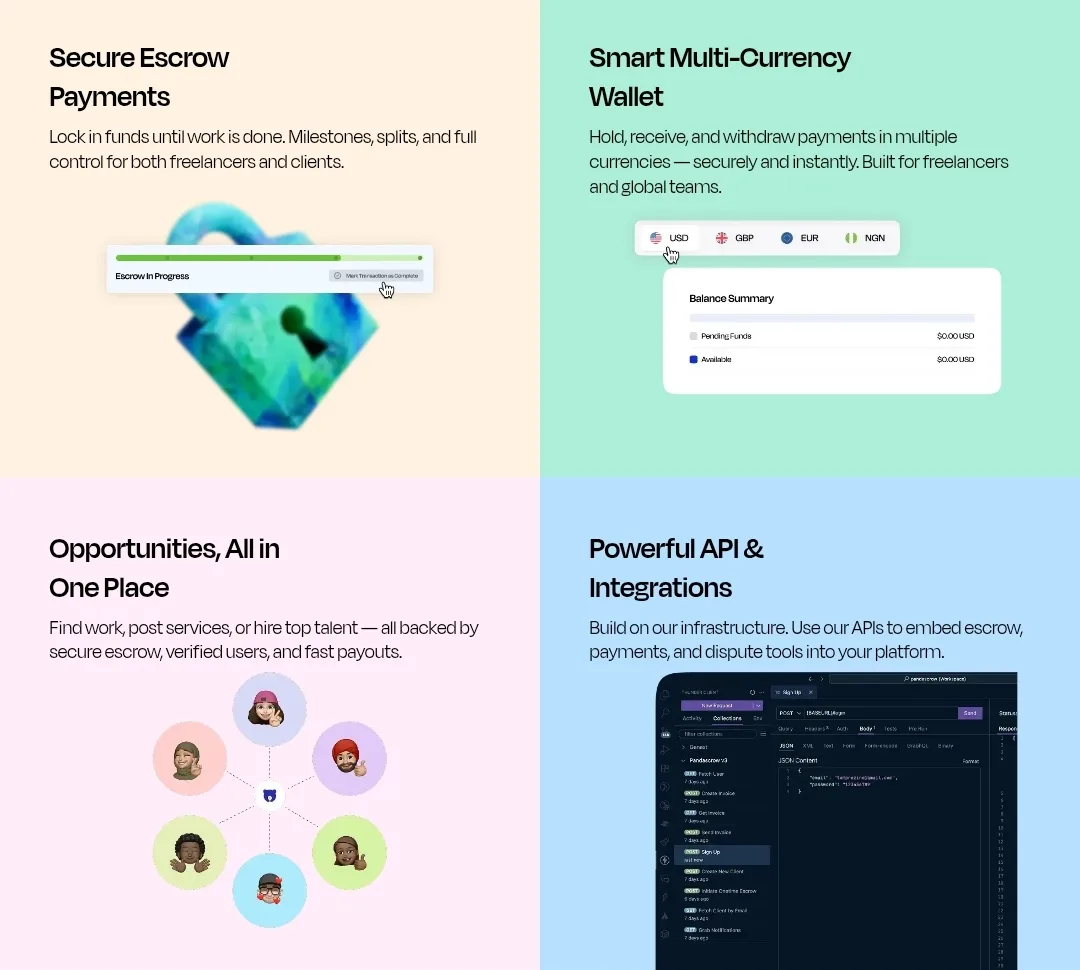

Pandascrow works as an escrow-based payment solution for local and cross-border transactions. In every transaction, funds are held securely until both the buyer and seller confirm satisfaction. Precious maintained that this method prevents fraud and ensures that neither party loses money unfairly.

Moving forward, he described how the system solves a very common issue in online business which is lack of trust. In Africa, many people still prefer cash or face-to-face payments. This hesitation comes from stories of scams and failed online deals. Pandascrow addresses that fear directly. Furthermore, it holds payments until both sides meet the agreed terms. Once the buyer confirms delivery or service completion, the money is released instantly to the seller.

According to the Founder, this approach is not just a technical fix but a cultural shift. People begin to trust again when they see that a transaction system truly protects them. That, he said, is what the Pandascrow escrow system stands for.

How Pandascrow Escrow System Keeps Transactions Safe

Precious went on to describe the system’s safety measures. Every user goes through proper verification before transacting. The platform uses strong data protection and continuous fraud monitoring. Additionally, every action on the platform is checked in real time to spot suspicious activities.

He added that Pandascrow partners with regulated financial institutions to guarantee transparency. This ensures that every transaction follows financial compliance rules. He explained that security is not a feature that comes later because such is the foundation of Pandascrow. Everything else is built on that foundation.

According to him, the Pandascrow escrow system uses “bank-level protection” for all funds. This means that from registration to payment release, data is encrypted and shielded. “People should sleep at night knowing their money is safe,” he said calmly. That, for him, is the heart of digital confidence.

Multi-Currency Wallet and User Experience

As the conversation deepened, Precious explained that the Pandascrow escrow system allows users to send, receive, and hold funds in multiple currencies. The dashboard was designed to make it easy to switch between currencies and manage balances.

He said that many freelancers and online entrepreneurs in Africa struggle with foreign payments. Some clients pay late, others deduct hidden fees, and some even cancel midway. Pandascrow’s system prevents these frustrations. When money enters escrow, both sides can see it. The funds are released only when everything is done correctly.

Precious also discussed the user interface. He mentioned that the design was kept simple on purpose. Many payment apps are overloaded with icons and tabs that confuse users. Pandascrow took a different path. “We tested our design with older people,” he said. “If they can use it easily, anyone can.” That feedback helped the team refine the experience for users of all ages.

Fair Currency Conversion and Transparency

Moving ahead, Precious explained Pandascrow’s currency conversion and said there’s usually a small difference between buy and sell rates. This difference, known as the spread, helps cover conversion costs.

However, he emphasized that the Pandascrow escrow system is upfront about it. Users see all rates before they confirm a transaction. There are no hidden deductions or last-minute surprises. He stressed that transparency builds confidence, and confidence leads to repeat usage. The platform relies on fairness and not tricks.

When asked about the system behind these conversions, Precious said Pandascrow uses CBN’s standard financial suite. He said it helps maintain accuracy and fairness in exchange rates across currencies.

Pandascrow Escrow System’s Long-Term Vision

In furtherance of the discussion, Precious leaned forward slightly as he spoke about the long-term vision of his startup with visible excitement. He said the company’s goal is to create a trust layer for digital trade in Africa. It’s not only about payments, it’s about helping people believe in the digital economy again.

He explained that once people can trust a payment system, they start doing more business online. Freelancers can work with foreign clients without worrying about fraud. Merchants can sell to buyers in other countries with confidence. In his words, “trust is the real currency of online trade.”

Pandascrow wants to make that currency abundant across Africa. Precious said that this mission is what drives the team daily. “We want a continent where a seller in Lagos can trade with a buyer in Nairobi without fear.”

Quick and Fair Dispute Resolution

“Disputes are inevitable in business, but how they are managed defines the brand,” says Precious Tom. He explained that Pandascrow has a built-in chat channel where parties can talk directly. If they can’t resolve things themselves, the system allows for arbitration.

He proudly mentioned that the average time to resolve disputes is just about thirty minutes. The process is simple, fair, and quick. Once a resolution is reached, the funds are released according to the agreement. This speed, he said, keeps people from losing faith when disagreements arise.

Looking Ahead

The Pandascrow escrow system is more unlike a tech platform; rather, it’s a trust movement for Africa. It comes with safety, clarity, and fairness to digital transactions. In the same vein, it gives individuals, freelancers, and businesses the courage to trade beyond borders.

In an environment where online scams still dominate and consequently discourage many, Pandascrow stands as proof that trust can be built with the right mix of technology, transparency, and human care. As Precious said in closing, “We don’t just move money, we move confidence.”